real property taxes las vegas nv

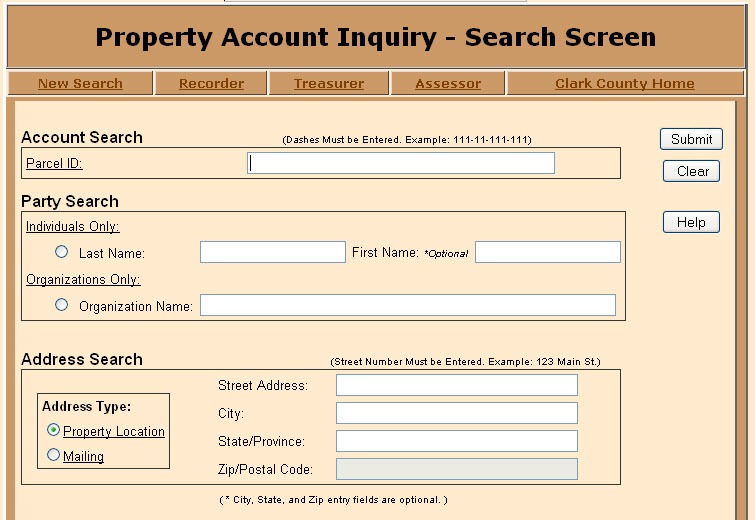

Account Search Dashes Must be Entered. 500 S Grand Central Pkwy 1st Floor.

Enterprise Real Estate Enterprise Las Vegas Homes For Sale Zillow

Nearby homes similar to 7350 Real Quiet Dr have recently sold between 785K to 1500K at an average of 245 per square foot.

. Las Vegas NV 89155-1220. The assessed values are subject to change before being finalized for ad valorem tax purposes. Overall there are three stages to real property taxation.

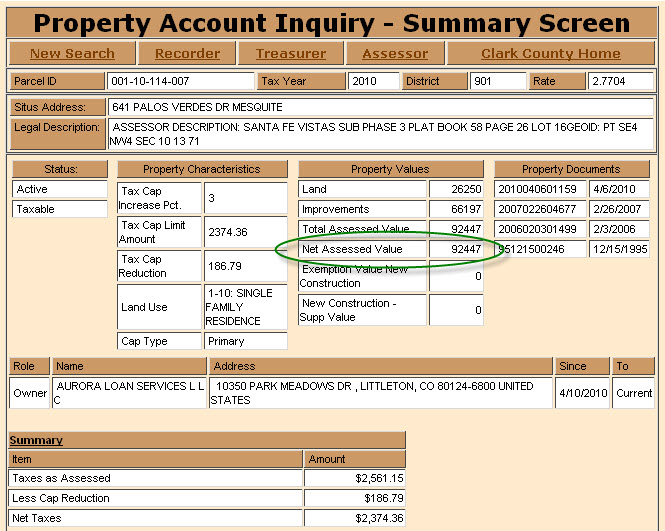

The Clark County Treasurer provides an online payment portal for you to pay your property taxes. To determine the assessed value multiply the taxable value of the home 200000 by the assessment ratio 35. Every municipality then receives the assessed amount it levied.

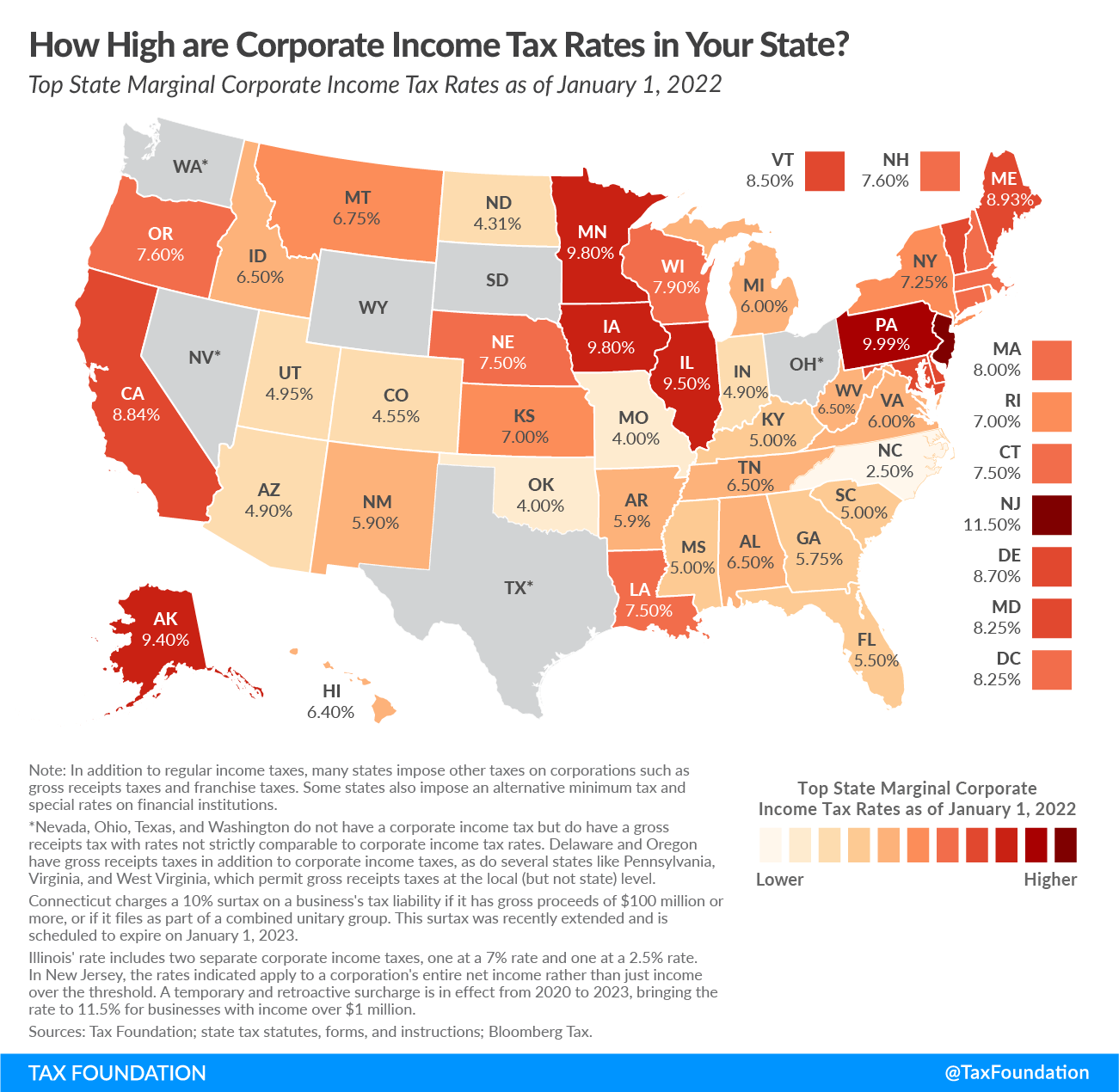

View or Pay Real Property Taxes. A citys real estate tax rules must comply with state constitutional rules and regulations. Nevada is ranked 28th of the 50 states for property taxes as a percentage of median income.

Real Property Tax Payment Options. Property Account Inquiry - Search Screen. By E-check or credit card Visa MasterCard and Discover.

Taxation of properties must. Las Vegas NV 89106. 1200000 Last Sold Price.

The exact property tax levied depends on the county in Nevada the property is located in. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323 option. We encourage taxpayers to pay their real property taxes using our online service or automated phone system.

200000 X 35 70000 assessed value. 111-11-111-111 Address Search Street Number Must be Entered. Checks for real property tax payments should be made payable to Clark County.

1 be equal and uniform 2 be based on current market value 3 have. Home Government Assessor Real Property Property Search Real Property Records. - 530 pm Monday through Thursday except for.

The Assessor parcel maps are for assessment use only and do NOT represent a survey. To calculate the tax. NRS 3614723 provides an abatement of taxes by applying a 3 increase cap on the tax bill of the owners primary residence single-family house townhouse condominium or.

123 Main St. SOLD JUN 13 2022. The states average effective.

Nevadas property tax rate is constitutionally limited to five percent of assessed value not market value. You may pay in person at 500 S Grand Central Pkwy Las Vegas NV 89106 1st floor behind the security desk. What is the Property Tax Rate for Las Vegas Nevada.

Upon the transfer of any real property in the State of Nevada a special tax called the Real Property Transfer Tax is imposed. Homeowners in Las Vegas NV Benefit from Low Property Tax Rates In Nevada property taxes are among the lowest in the country. Pretend your house located within Las Vegas is valued at 200000 with a tax rate of 35.

The County Recorder in the county where the property is. Real property taxes las vegas nv. In Nevada the market value of.

Grand Central Pkwy Las Vegas NV 89155 702 455-0000 Copyright 2021 Clark County NV Login. We are open 730 am. Real Property Tax Information.

If an existing home has already qualified for a 3 or 8 tax abatement taxes will be calculated on the assessed value or apply the appropriate tax cap percentage to the tax amount paid in the. Establishing tax levies evaluating property worth and then collecting. TAX DISTRICT DISTRICT NAME FISCAL YEAR 2020 - 2021 TAX RATE FISCAL YEAR 2021 -.

In Las Vegas NV estimated annual. Please visit this page for more information. If your new home doesnt qualify for a tax exemption you can calculate your property tax this way.

Real Property Tax Auction. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. Real Property Tax Auction Information.

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Clark County Property Taxes Misinformation Addressed By Assessor Las Vegas Review Journal

6 Facts Every Homeowner Should Know About Property Taxes Las Vegas Review Journal

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Nevada Tax Advantages Luxury Real Estate Advisors Las Vegas Real Estate

Where People Pay Lowest Highest Property Taxes Lendingtree

Mesquitegroup Com Nevada Property Tax

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

335 E Silverado Ranch Blvd Las Vegas Nv 89183 Loopnet

Luxury Estate Las Vegas Real Estate 15 Homes For Sale Zillow

Nevada Vs California Taxes Explained Retirebetternow Com

Mesquitegroup Com Nevada Property Tax

Free Nevada Real Estate Purchase Agreement Template Pdf Word

Nevada Is The 9 State With The Lowest Property Taxes Stacker

Clark County Property Taxes Misinformation Addressed By Assessor Las Vegas Review Journal

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty